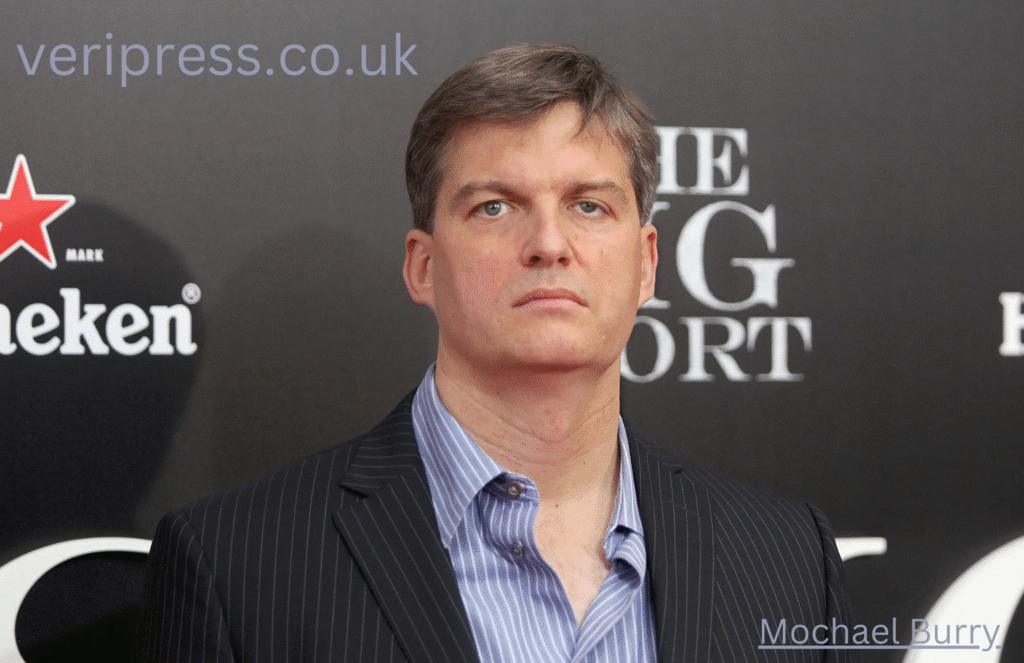

Let’s be honest—most of us have, at some point, wished we could see the future. Especially when money is involved. Bills, savings, investments… it’s stressful. And then you hear about someone who not only saw a financial disaster coming but had the courage to bet against the entire system. That’s where Mochael Burry comes into the conversation.

Now, you might be thinking, Do you mean Michael Burry? Yes—most people do. But interestingly, “mochael burry” has become a widely searched variation online, and that curiosity says a lot. People aren’t just looking for a name. They’re looking for understanding. They want to know how one person thought differently when everyone else followed the crowd.

So let’s slow down, unpack the story, and actually learn something useful from it.

Who Is Mochael Burry (Michael Burry, Explained Simply)

Before the headlines, before the fame, before the movie scenes—Mochael Burry was simply someone who paid attention.

A Different Kind of Investor

Unlike traditional Wall Street professionals, Burry didn’t start with flashy connections. He came from a medical background and taught himself finance by reading balance sheets late into the night. And honestly, we’ve all been there—obsessing over something no one else seems to care about.

But here’s what made him different:

He didn’t just read numbers. He questioned them.

Why His Name Became So Well Known

Mochael Burry rose to global attention for predicting the 2008 housing market crash—years before it happened. While banks, analysts, and investors were celebrating endless growth, he noticed something uncomfortable.

The math didn’t add up.

And instead of ignoring that feeling, he leaned into it.

The Big Short Moment: When Conviction Beat Popular Opinion

You know what’s interesting? Being right too early often feels exactly like being wrong.

Betting Against the Crowd

At the peak of the housing bubble, Mochael Burry took positions that went directly against the market. People laughed. Clients panicked. Institutions pushed back.

But he stayed focused on the data.

And that’s the lesson most people miss:

Conviction without evidence is arrogance. Conviction backed by research is power.

Emotional Pressure and Mental Strength

Imagine this for a second. Everyone around you says you’re wrong. Your inbox is full of angry messages. And the market keeps going up… for a while.

Would you hold?

Burry did. And that mental resilience is just as important as financial intelligence.

How Mochael Burry Thinks About Risk

Most people misunderstand risk. They think it’s about volatility. Burry sees it differently.

Risk Is Not What Feels Scary

According to the philosophy associated with Mochael Burry:

- Risk is ignoring fundamentals

- Risk is blind optimism

- Risk is following trends without understanding them

And yeah, that hits close to home for many investors.

Margin of Safety Matters

One of Burry’s core ideas is building a margin of safety—buying assets with enough downside protection that even if you’re partially wrong, you survive.

It’s not glamorous. But it works.

Investment Style: Why Mochael Burry Avoids the Spotlight

Unlike many famous investors, Burry doesn’t chase media attention. In fact, he often disappears from public view entirely.

Focus Over Fame

He’s known for:

- Concentrated positions

- Deep research

- Ignoring short-term noise

And honestly, that’s refreshing in a world obsessed with constant updates.

Long-Term Thinking in a Short-Term World

Mochael Burry’s approach reminds us that patience is a competitive advantage. While others refresh charts every five minutes, he zooms out.

Way out.

Lessons Everyday People Can Learn From Mochael Burry

You don’t need millions of dollars to think like a disciplined investor.

1. Do Your Own Homework

Trust me—outsourcing thinking is expensive. Burry’s story proves that independent research matters more than expert opinions.

2. Be Comfortable Being Uncomfortable

If everyone agrees with you, you’re probably late. Some discomfort is the price of original thinking.

3. Ignore the Noise (Seriously)

Markets are loud. Social media is louder. Mochael Burry’s success came from tuning out distractions and focusing on facts.

Mochael Burry and Market Warnings: Why People Pay Attention

Every time Burry shares a concern, the internet explodes. But here’s the truth—he’s not predicting doom for attention.

Patterns, Not Panic

Burry looks for:

- Excess leverage

- Mispriced risk

- Structural weaknesses

And when those patterns appear, he speaks up. Sometimes he’s early. Sometimes the timing is debated. But the thinking process remains valuable.

Why His Opinions Still Matter

Even when people disagree, Mochael Burry forces conversations that others avoid. And that alone has value.

The Psychology Behind His Success

This part doesn’t get talked about enough.

Obsession Can Be an Asset

Burry is known for extreme focus. While that level of intensity isn’t for everyone, it shows what’s possible when curiosity turns into mastery.

Emotional Control Beats Intelligence

Plenty of smart people fail in markets. Emotional discipline—sticking to a plan when emotions run high—is what separates survivors from casualties.

Common Misunderstandings About Mochael Burry

Let’s clear a few things up.

He’s Not Always “Bearish”

People label him as negative, but that’s lazy thinking. He’s not against markets—he’s against mispricing.

He’s Not Guessing

Every move is backed by data, not headlines. And that distinction matters more than ever today.

Why the Story of Mochael Burry Still Resonates

So why do people keep searching for mochael burry years later?

Because his story speaks to something deeper:

- Standing alone

- Trusting your analysis

- Being patient when others rush

And honestly, that applies far beyond investing.

Conclusion: Think Differently, Act Carefully

At the end of the day, Mochael Burry isn’t famous because he predicted a crash. He’s remembered because he thought independently when it mattered most.

You don’t have to copy his trades. You don’t have to agree with every view. But you can adopt the mindset—question assumptions, respect risk, and stay grounded in reality.

So next time the crowd gets loud, pause. Look closer. And don’t be afraid to think differently.